What is Nexi Open

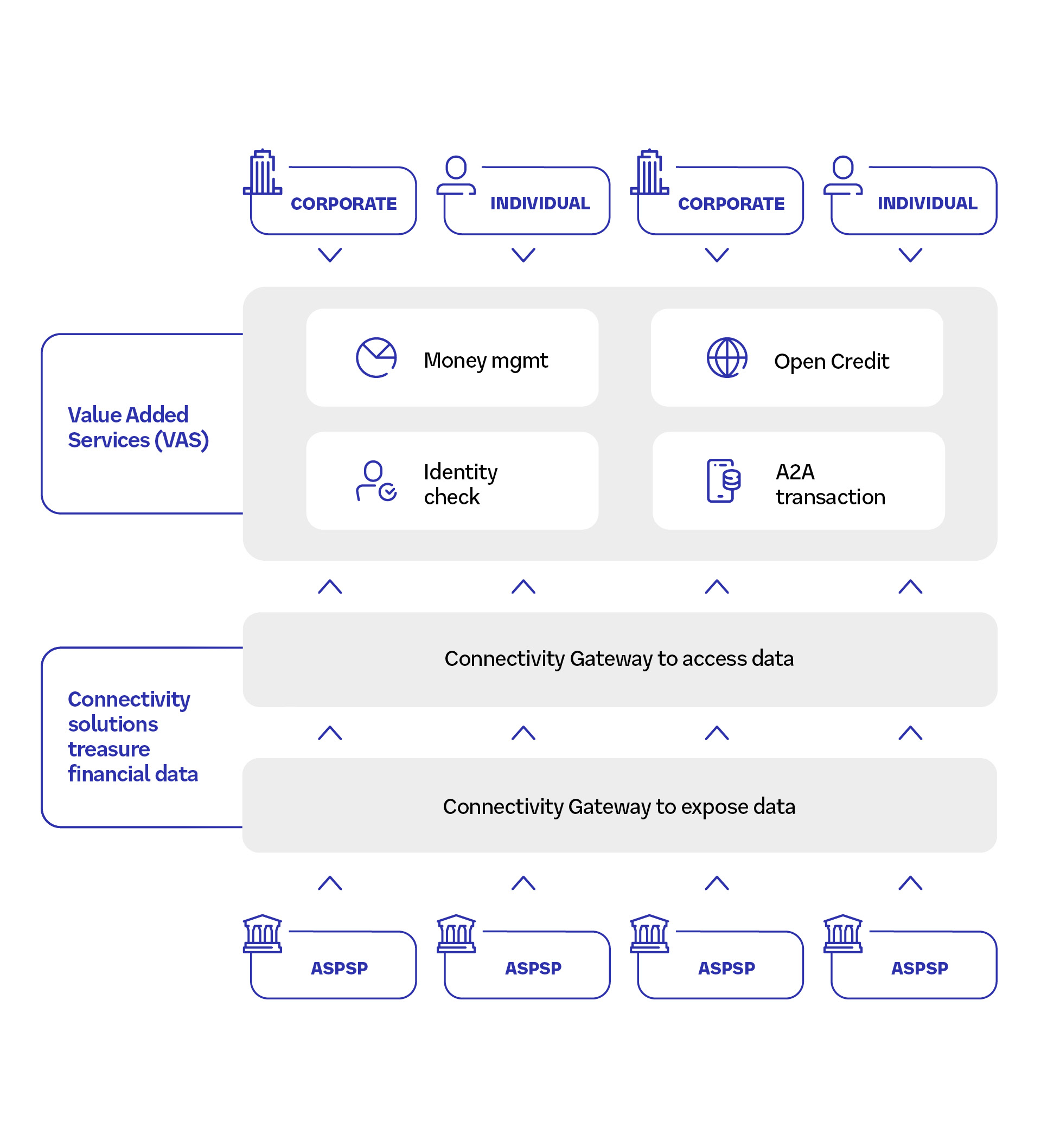

Open Banking is, literally, the system of open banking data, in which the financial information of bank customers is shared—subject to the customers' consent—between banks and third-party providers (TPPs) to develop innovative products and services.

This is made possible through banks' use of APIs (Application Programming Interfaces), allowing TPPs to access customer account balances, spending details, and transaction flows.

Simply a new, constantly evolving ecosystem of business opportunities.

A great opportunity, not only for financial operators but for any corporation eager to innovate and implement new technological and payment solutions to enhance customer experience and streamline business processes.

Nexi Open ecosystem

Money Management

Open Credit

Connectivity

Our partners

We collaborate with both international and Italian entities to develop services that cover a wide range of use cases and continuously monitor the most interesting international startups to capture and assess tomorrow’s innovations and make them available to our clients.

Today, we partner with:

Would you like to receive details about Nexi Open?

Fill out the form with all the necessary information, and we will get back to you as soon as possible.