Over the last decade, cash has faded, contactless has surged, and mobile wallets have gone mainstream. Relentless digitalization has changed everyday payments beyond recognition, yet the checkout has remained largely static: familiar, trusted and functional; yet slow, uninspiring and impersonal. But the checkout is changing. New technologies, shifting consumer demands, and an ever-evolving political and economic landscape means 2026 will be a year of personalization, protection and partnership, transforming the checkout experience for merchants and consumers alike.

In part two of our three-part series, Tommaso Jacopo Ulissi, Head of Strategy and Transformation assesses why personalized payments and verticalized software will be critical in helping merchants differentiate themselves in a hyper-competitive market…

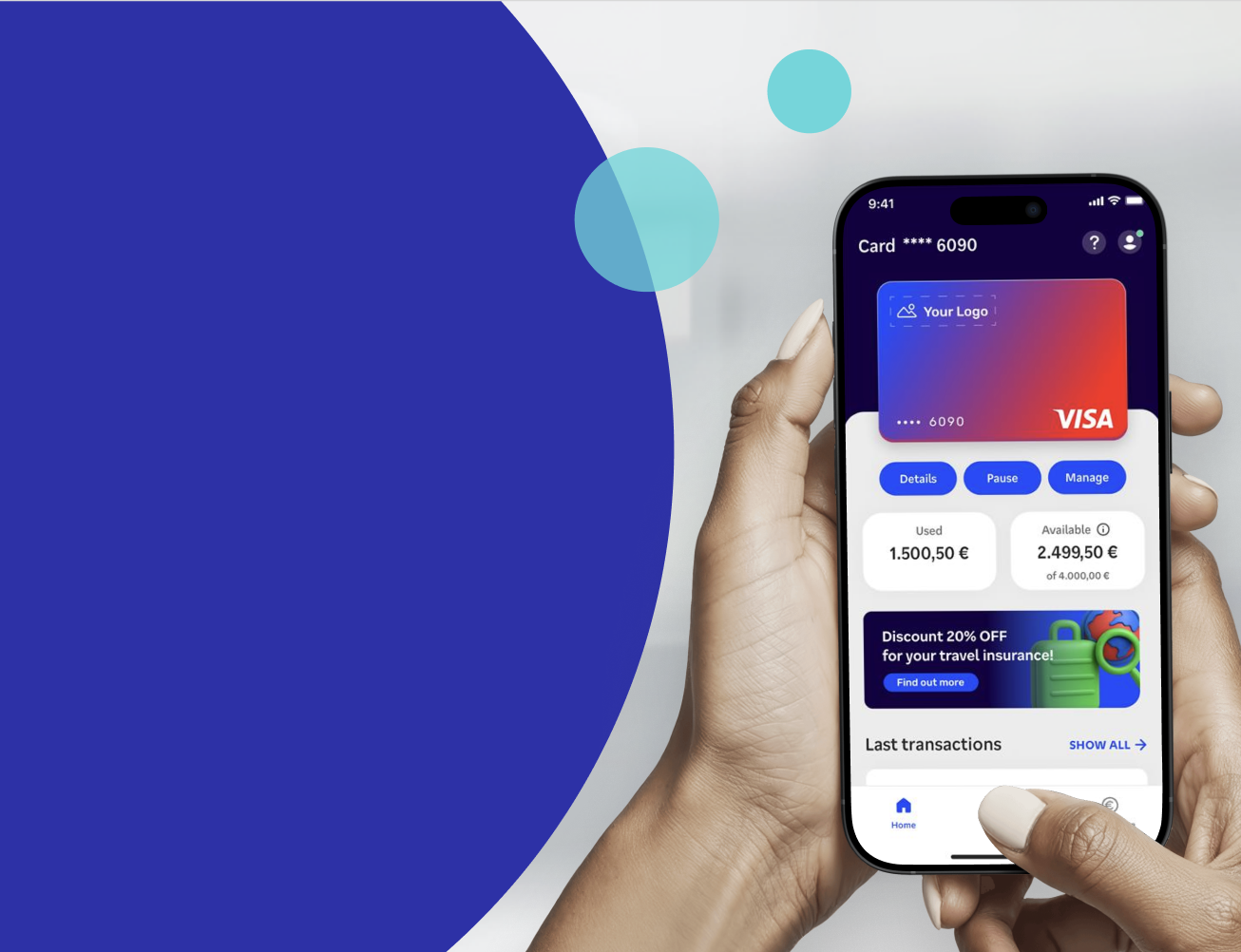

In 2026, a fresh fusion of personalised payments and verticalised software will mark a major leap forward in how merchants differentiate themselves, ensuring their customers feel recognized and valued with each transaction.

By tailoring the checkout to the environment in which it is being used, instead of adopting a one-size-fits all approach, merchants in 2026 can differentiate themselves more distinctly than ever before, offering an experience that adds mutual value to the business and its customers. One industry primed for a personalization transformation in 2026 is hospitality.

Hospitality is highly specialized, with a dynamic ecosystem of enabling platforms. Guests expect everything to be fast, easy, and personal. Merchants, meanwhile, are increasingly seeking a unified combination of innovative hardware and agile software to deliver a streamlined “one-stop-shop” experience and exceptional customer service.

Integrated payments across the entire hospitality stack can tie guest profiles to a personalized customer offer, supported by seamless payments at every touchpoint. So, in 2026, whether you are checking in, booking a spa treatment, or ordering dinner at the restaurant, you can pay without friction and without interruption, creating the ultimate guest experience.

Restaurants themselves are a unique use case for payments: you pay after consuming the goods, the bill may be split, and you may choose to tip the staff with something extra, for example. One supporting technology expected to grow in 2026 is designed to support such varied needs and behaviours, not just on behalf of paying customers, but for business operations too.

SmartPOS is one example of a unified commerce solution that transforms the checkout from a simple payment-acceptance station into a comprehensive business operations hub. Businesses using the technology in 2026 can enhance their operational efficiency, enabling staff to manage fragmented business operations services, such as bookings or inventory management, all from a single terminal.

The same SmartPOS terminal, keeping with our restaurant example, can not only offer payment options tailored to the customer’s preference, but it can also: recognize returning customers and automatically apply loyalty benefits; recall previous orders to make tailored menu suggestions; and enable staff to personalize interactions at the table, based on a guest’s dining history.

Finally, 2026 will mark the beginning of a new trend that could completely transform how we shop online: agentic commerce. Agentic commerce offers every consumer access to their own personal, highly intelligent shopping assistant. No longer will we spend time and effort browsing countless websites trying to find the right product, in the right size, for the right price, with the right delivery option. The AI agent will do the heavy lifting for us, providing options to approve, based on our criteria. All we will do as a shopper is select our preferred option and authorize the AI agent to buy it on our behalf, using secure, tokenized card details.

We have seen the first bold steps towards this in 2025: OpenAI launched “Buy it in ChatGPT”, enabling users in the U.S. to make single-item purchases with select retailers. The Generative AI giant also announced that PayPal wallets will be integrated within its Instant Checkout offer from 2026.

Every week there is more movement in this space and at Nexi, we're pleased to be involved in the development of Google’s Agent Payments Protocol (AP2), which enables users to initiate and transact secure, agent-led payments through mandates and verifiable credentials. As such technology matures and users gain trust and familiarity with agentic commerce, we expect the traditional checkout – where the user browses a site and adds items to a basket – to be turned on its head.

Missed Episode one? Go back and read Software-based payments will take center stage in 2026.

Stay tuned for the third and final episode, in which Tommaso addresses the critical role of sovereignty and resilience in 2026 and beyond…