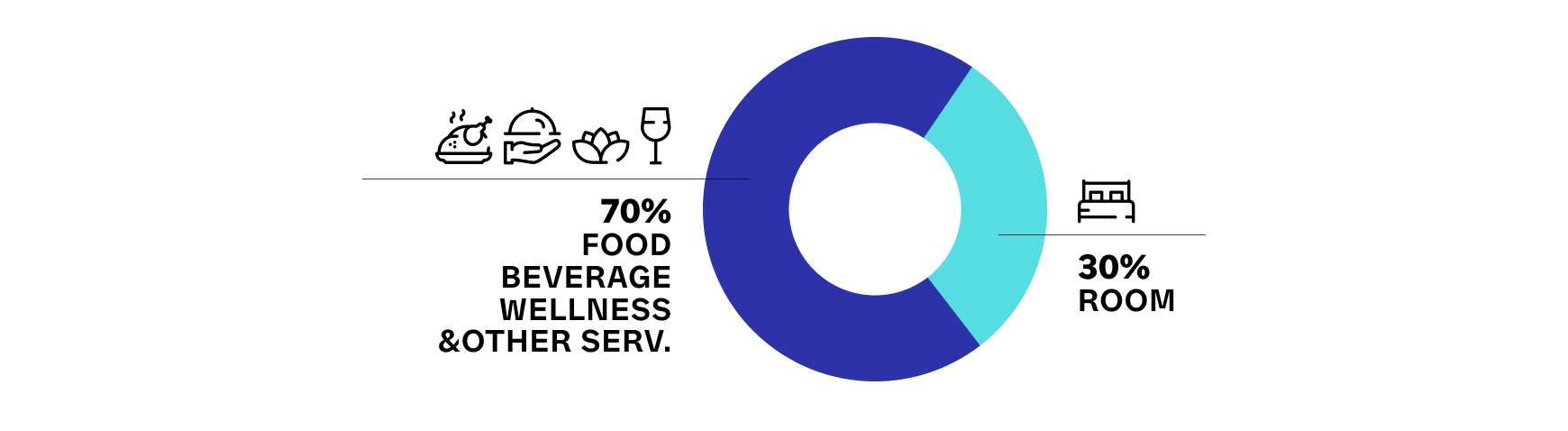

As guest preferences shift and spending habits evolve, the pressure is on hotels to deliver seamless, tech-enabled experiences. In a world where only 30% of guest spend goes toward rooms, the remaining 70%, covering food and beverage, wellness, and other services, is where the real opportunity lies.

To unlock that potential, hotels must go beyond basic transactions. With the help of integrated payments and AI, payments can evolve into a powerful tool for revenue growth and guest satisfaction.

Why modern payments are key to hotel performance

Guests today expect the ease and speed of digital-first experiences with everything from mobile check-ins, contactless payments, to instant confirmations. Yet, many hotels still operate with outdated, fragmented systems that create friction and drive-up costs.

Integrating payments across your property management systems (PMS), point-of-sales, and booking systems ensures every transaction is connected to the guest profile and hereby simplifying check-ins, streamlining purchases, and capturing more value throughout the stay.

Turning payments into personal experiences

With AI and real-time payment data, hotels can move from reactive to proactive. By analysing guest behaviour, hoteliers can tailor offers in the moment. Whether it’s upselling spa services to a guest who booked a deluxe room or sending a late-night dining offer based on bar spend, real-time insights are essential. Tokenisation and one-click payment solutions further reduce barriers, making each interaction fast, secure, and personalised.

Outdated systems cost more than time

Clunky payment setups do not just inconvenience guests, they also put revenue, compliance, and brand trust at risk. High processing fees, data vulnerabilities, and operational inefficiencies add up fast.

Worse, when staff spend time troubleshooting payment issues instead of serving guests, the guest experience suffers.

Three ways hotels can boost revenue with integrated payments.

To stay competitive, hoteliers should rethink payments as a strategic lever, not a backend process:

Unify payments within your PMS. This creates a seamless experience across check-in, dining, spa, and other services while boosting upsell opportunities.

Adopt tokenised,

pre-authorised payments.

This not only improves con-venience for guests but also reduces fraud and abandoned purchases.

Use AI-powered insights to personalise offers.

With real-time data, you can spot revenue gaps and proactively offer relevant services that match guest behaviour.

Read the whole blog article here: How hotels can leverage data and AI to optimise payments | Planet

Our integrated solution for hospitality

Nexi | Planet Hospitality is built specifically for hospitality merchants. As a full-stack payment solution, we integrate with all major PMS providers, support local payment methods, and offer on-the-ground expertise in your market. We also support Dynamic Currency Conversion (DCC) allowing international guests to pay in their home currency while generating an extra stream of revenue for your hotel.

Integrated payments do not just make transactions easier; they are an essential lever for revenue growth, guest satisfaction, and operational efficiency. With Nexi | Planet Hospitality, hotels can deliver a frictionless guest experience while maximising revenue from every interaction. One guest, one stay, one payment journey - all connected.