The New Nordic Shopper: Digital Meets Physical

In the Nordic region, a new type of consumer is emerging: digitally savvy yet still loyal to physical stores. While 91% of shoppers buy online, traditional retail remains essential for everyday essentials like groceries. This hybrid commerce trend is redefining how businesses approach retail.

Mobile devices are now the backbone of this transformation, driving 70% of online purchases and 50% of in-store payments. Local wallets are booming, particularly in Sweden, while self-checkout adoption is still evolving.

For retailers, the takeaway is clear: adopt mobile-first and omnichannel strategies to match evolving customer expectations.

Payments in the Nordics Are Rapidly Changing

The Nordic payments landscape is evolving at high speed. With new fintech players and increasing cross-border transactions, the ecosystem is more complex, yet consumers demand seamless and secure payment experiences.

Our H1 2025 Nordic Payments Outlook, based on insights from nearly 4,000 Nordic consumers, reveals how these shifts are shaping online and in-store shopping trends.

Hybrid Shopping Is the New Norm

Nordic countries are digital leaders, with cash accounting for less than 10% of transactions. Digital payments - including cards, mobile apps, and local wallets - dominate.

Consumers are blending online and offline shopping effortlessly.

91% of consumers shop online regularly

- 45% purchase clothing online

- 30% buy pharmacy products online

- 26% shop beauty products online

- 25% purchase groceries online

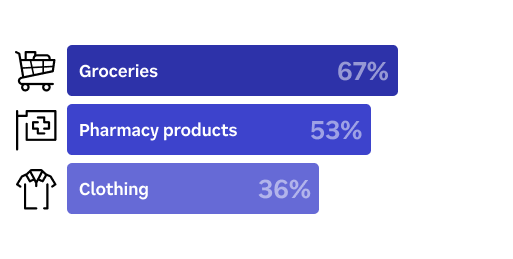

In-store shopping still plays a key role for daily needs:

- 67% groceries

- 53% pharmacy products

- 36% clothing

- 34% bars and cafés

- 31% fuel

- 29% fast food

This hybrid approach highlights consumer flexibility, switching between channels for convenience and confidence.

Mobile Payments Dominate

Nordic shoppers are increasingly mobile-first:

- 50% use smartphones for in-store payments

- 70% rely on mobile for online purchases

Top motivations include:

- 50% Speed and convenience

- 22% Loyalty rewards

- 21% Expense trackin

- 20% Security

Local wallets are seeing strong adoption, particularly among older demographics

- Sweden (70.3%)

- Norway (62.5%)

- Denmark (56%)

- Finland (38%)

Card payments still dominate in Denmark and Finland, while Norway shows a near-even split. In Sweden, wallets now surpass cards, signaling a significant shift toward digital-first payments.

However, some consumers still hesitate: 32% avoid in-store mobile payments due to unfamiliarity, and 22% cite security concerns.

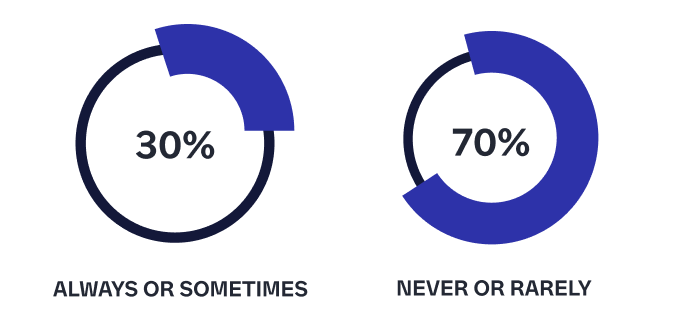

Self-Checkout Adoption Is Growing Slowly

Around 30% of Nordic consumers use self-checkout regularly or occasionally, but 70% still prefer staffed checkouts.

Reasons include:

- Desire for human interaction (26%)

- Perception that self-checkout is slower (25%)

- Limited availability (23%)

Greater access and improved experiences could increase adoption rates in the near future.

Key Takeaways for Retailers

Nordic consumers are increasingly channel-agnostic, blending online, in-store, and mobile experiences. To meet these expectations, omnichannel strategies are crucial.

With 70% of online purchases and half of in-store transactions conducted via smartphone, businesses must prioritize mobile in the customer journey.

The future of payments in the Nordics is digital, mobile-first, and connected — and it’s happening now.