The payments market is undergoing a significant transformation, presenting challenges for Payment Service Providers (PSPs) to stay competitive. This shift is driven by technological advancements, regulatory changes, and evolving customer expectations.

Direct access to advanced payment systems enables PSPs to streamline operations, enhance scalability, and offer real-time payment solutions. However, this also requires PSPs to manage increased operational costs and comply with stringent technical and security standards. These changes position PSPs to better meet market demands and foster innovation in the payments landscape.

Revealing New Opportunities in the Payments Landscape

Payment Service Providers (PSPs) have a unique opportunity to enhance their market position. Nexi provides seamless integration, regulatory compliance, and innovative solutions to help PSPs achieve greater independence and reduce costs. By partnering with Nexi, PSPs can lead the charge in the evolving payments landscape and unlock new revenue streams.

The shift to direct access to TARGET and EBA Clearing services is a watershed moment for PSPs. By capitalizing on this opportunity, PSPs can position themselves as central players in the instant payments ecosystem, unlock significant cost savings, and tap into a rapidly growing market.

Unlocking Potential: Direct Access to Advanced Payment Services

In 2025, Payment Service Providers (PSPs) will have direct access to the European Central Bank’s and EBA Clearing services. This game-changing development empowers PSPs with: greater independence, cost savings and streamlined operations.

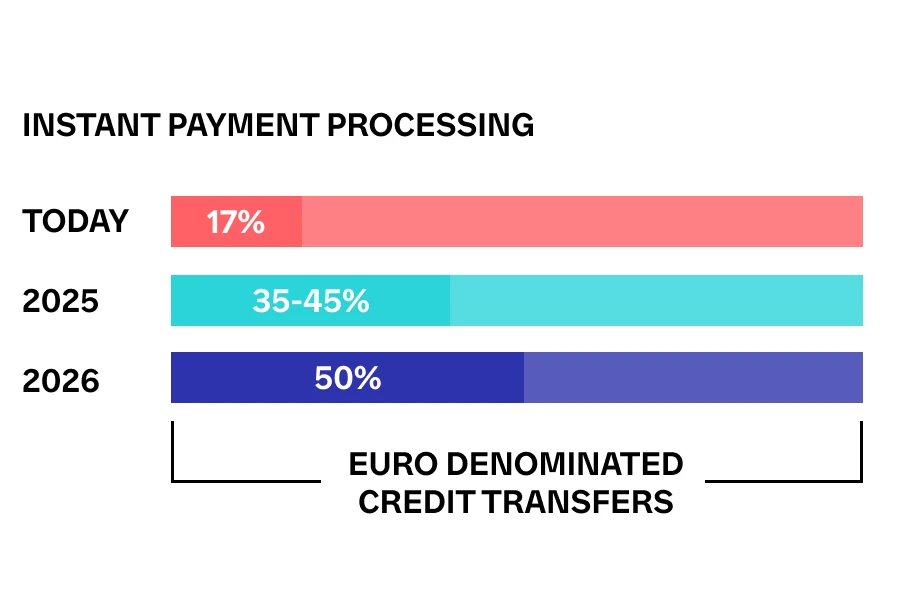

As instant payments rapidly gain traction across Europe, with volumes expected to soar to 35-45% of all transactions by the end of 2025 and 50% by 2026, PSPs are poised to seize significant market opportunities and untapped revenue potential.

Strategic Insights: Leading the Instant Payments Revolution

Innovative Payment Service Providers (PSPs) are uniquely positioned to lead the charge in instant payment adoption. Allowing non-bank payment service providers to open accounts at central banks reduces reliance on commercial banks, helping to lower systemic risks in the payments landscape. Key strategies include:

Speed

and efficiency

- Instant Transactions are particularly valuable for businesses that need fast payments or for customers who want to avoid delays.

- Faster Cash Flow for Businesses improves liquidity and reduces cash flow gaps.

Driving market innovation

and farier competition

- FinTech companies, such as PIs and EMIs, can compete with traditional ecosystem, spurring the creation of faster and more affordable payment services.

Rethink

your business

- Greater flexibility to design and tailor its instant payment system to meet the specific needs of its customers.

Nexi: Your Competitive Edge

With a proven track record and extensive expertise, Nexi is your trusted partner in navigating the transition to direct TARGET and EBA Clearing access. Our solutions are designed with reliability, compliance, and scalability in mind, ensuring your organization’s success in this dynamic and competitive landscape. Our strengths:

- Reliability: with years of experience and a proven track record, Nexi is a trusted partner for PSPs navigating the complexities of the European payment system.

- Comprehensive solutions: Our end-to-end managed services cover every aspect of integration, from initial setup to ongoing support, ensuring a smooth and hassle-free experience.

- Regulatory compliance: Nexi’s solutions are designed to meet the highest standards of regulatory compliance, giving PSPs peace of mind and reducing the risk of non-compliance.

- Scalability: our solutions are built to scale with your business, allowing you to grow and adapt to changing market conditions without disruption.

- Innovation: Nexi is committed to continuous innovation, staying ahead of industry trends and providing cutting-edge solutions that keep PSPs competitive.